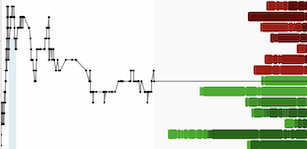

It was the largest single day loss ever for the GDX on a day in which the GDX still managed to close above its 200-day moving average, closing down 9.86%:

GDX (Daily)

Odds favor a bounce following a beating like yesterday, however, a deeper sell-off today would actually set up better opportunities from a trading standpoint.

Given the extent of yesterday's damage we have probably entered into a multi-week corrective phase which, in my opinion, will see more sideways price action with a correction coming more from time and boredom than by additional severe price drops.

Simply stated, we will be looking to buy the gold miners on additional weakness today. We will NOT chase a gap higher today.

Meanwhile, interest rates are the real story and the 10-year note yield is facing a major test of resistance in the 1.73%-1.75% range:

A breakout above 1.75% would be significant to say the least and have far reaching implications across other major markets and asset classes. And that's a story for another day.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author and Mr. Moriarty’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Japan Gold Inc. is a sponsor of EnergyandGold.com and so some information may be biased. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.