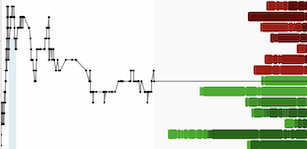

Gold continues to build energy within the range it has been trading in all summer:

Gold (Daily)

The streak of lower highs since the July peak remains intact and the price action has recently centered around the midpoint of the summer range, ~$1340. It's also interesting to note that if you look at the bottom part of the chart, gold options implied volatility (GVZ) has begun to peak up ever so slightly despite gold itself trading relatively calmly. An indication that a larger move is right around the corner?

A thrust above $1360 is what it would take for me to turn outright bullish, whereas gold will still be rangebound and neutral unless we experience a breakdown below major support at $1310.

DISCLAIMER: The work included in this article is based on current events, technical charts, and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher ofEnergyandGold.com. This publication is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.comfor important risk disclosures. It’s your money and your responsibility.