Where dreams come true, unless you're an investor with Disney stock in your portfolio. Disney shares stumbled to their worst day since 2022 despite a surprising profit in their core streaming business. Here's what happened.

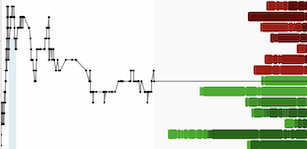

Disney stock took a nosedive on Tuesday, marking their worst performance since November 2022. The shares closed down 9.5% at $105.

Early on Tuesday, Disney reported $22.08 billion in revenue and earnings of $1.21 per share for the three-month period ending March 30, narrowly falling short of consensus analyst sales estimates of $22.12 billion but exceeding forecasts of $1.10 profit per share.

Disney also raised its guidance for full-year profit growth from 20% to 25%, though slightly below Wall Street's expectations of 25.3% growth.

Of particular interest was Disney's announcement of a $47 million quarterly operating profit for its Hulu and Disney+ streaming services. This marked a significant turnaround from the $587 million loss reported in the same period in 2023, a notable achievement for the broader direct-to-consumer segment, which had burned through over $8 billion in cash over the past three fiscal years.

CEO Bob Iger stated that Disney was on track to achieve streaming profitability by the end of the September quarter. Paid core subscribers to Disney+ reached 117.6 million in the quarter, surpassing expectations. However, the company predicted no user growth for Disney+ in the current quarter.

Disney aims to boost profitability by emulating Netflix's strategy of cracking down on password sharing, with plans to enforce this measure starting in June. After all, these updated rules contributed to the rise in Netflix stock, delivering advantages for the company.

Disney Experiences, the theme parks division, generated $8.4 billion in revenue with operating income at $2.3 billion. Disney noted that attendance trends at its parks were "normalizing" compared to the highs seen during the post-COVID economic reopening. Despite management's optimism about the business's future, Wall Street had higher expectations, leading to concerns about a growth slowdown.

Disney's poor performance weighed heavily on stock indexes on Tuesday. The S&P 500 index edged up by 0.1%, as investors sifted through a mix of earnings data. Nonetheless, the broad-based Wall Street benchmark has seen a solid 9% gain for the year, with a 3% increase so far in May.

With a quiet economic front on Wednesday, traders may take the opportunity to step back and strategize for the month ahead.