Talking My Book with Jay Currie and Peter @Netwon Bell $KLM

https://jaycurrie.substack.com/p/peter-bell-jay-currie-junior-resource

Peter Bell: Hello, I'm Peter Bell, and I'm here with Mr. Jay Currie. Hello, Jay.

Jay Currie: Hey, Peter. How are you doing?

Peter Bell: Pretty good. Thanks. How are you?

Jay Currie: I'm good. I'm good. It's the end of the week.

Peter Bell: Friday, January 5th, 2024. What are you looking at?

Jay Currie: This very instant, I'm watching the wonderful world of big Hercules silver and bayhorse silver BHS and the, and I love this, the Izey terrane.

Peter Bell: Idaho!

Jay Currie: Idaho and Oregon.

Peter Bell: And are we talking about Scout? Do you hear this name?

Jay Currie: I've heard Scout. What do you know about Scout?

Peter Bell: Well, they're private. So, not very much. But their name keeps popping up. There are a few noteworthy characters and some investors talking about them today. I saw them post on LinkedIn a week ago, and then I saw Willem Middelkoop on CEOCA mention them alongside BIG today. They're Idaho-focused, primarily the largest landholder claim holder in the state; something like that is a tagline. And they own their drill rig. There are some interesting ideas in play regarding the business model from Scout, as well as a little more vertical integration.

Jay Currie: Many people are looking at the IZ terrain where the IZ Terrain Sutures to the Old Fairy Terrain. I'm becoming like a GeoSpeak guy. I'm going to be able to do rock talk! Apparently, there are a whole bunch of Nevada plates at the motel in Huntington. I don't know what that means, but it means that there are some people out there staking. And our friends at a company you can invest in, Rio Tinto, are apparently quite interested. That's what I've been looking at this week.

Peter Bell: Not just potatoes!

Jay Currie: Not just potatoes anymore. The Silver Valley has been a thing for 100 years and is very deep. The other thing I've been paying attention to, because I wrote an article about it for Motherlode.tv, was my friend Tom Larson. It was less exciting than some people wanted it to be; believe it or not, the release on BIG took it from $1.50 down to $0.75. BIG didn't have terrible results. Those were solid results. It's the old story in the junior market -- the news has to be absolutely spectacular. You must have drilled into 20% copper for your shares to go up on a news release.

Peter Bell: And then more next time!

Jay Currie: The guys on the institutional side are just chuckling to themselves as they pick up shares for, you know, 75 cents a piece that used to cost $1.50. And over at El Oro, Tom is sitting on silver, zinc, tin, probably some gold, and maybe a little copper. It's this massive caldera in Bolivia, and honestly, if he had the money to do the drilling, then Tom could be putting out MREs on three different separate projects.

Peter Bell: Impressive.

Jay Currie: Shocking. It was funny talking to him because we go back quite a ways. He was my first broker back a thousand years ago. I've silenced Peter. Victory. It's an interesting time in the market.

Peter Bell: What a start to the year, Jay. What does the rest of the year hold?

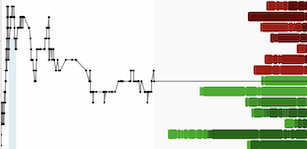

Jay Currie: I genuinely hope we'll see some strength come back into the juniors. We've been limping along now for three years, four years, however long, you know, you can pick your number. Maybe people will rotate into the juniors, and we'll see what happens.

Peter Bell: Why bother?

Jay Currie: That's precisely the exactly the question people are asking. Go into the ETF and earn 7% on your money.

Peter Bell: If you really want some excitement, go play the options on the majors. You've got more liquidity on the options on the Montreal exchange than you do for most of the juniors, which is a scary thought.

Jay Currie: Let me let me ask you this. You are the CEO of a real junior company now, and some people who have no idea what KLM, Kermode Resources, is doing will listen to this. In short, Peter, what to look forward to at KLM this year?

Peter Bell: No, sorry.

Jay Currie: Well, thanks, Peter!

Peter Bell: No, I can't. I am still determining what's coming for the year ahead. If you put me in January 2023, a year ago, could I tell you what to look forward to in the year ahead? I could give you some broad parameters: I probably would have said something about shares for services to fund exploration work. But in January 2023, I would have said Newfoundland and Vancouver Island. Now, in January 2024, I'm not going to say Newfoundland. I'll say Vancouver Island. I'll say Kootenays. I'll say Nevada. I'll say other places where we haven't been able to touch down yet -- the whirling dervish of deals is not done yet. I think we are still just getting started.

Jay Currie: Give me the way that you are functioning in the junior space with many projects and no money.

Peter Bell: We find the most competent, honest people with integrity and the relevant skill set to do early-stage prospecting exploration on projects they control and structure deals that incentivize them to go to war for the company.

Jay Currie: So you've got people who are doing the work.

Peter Bell: Day by day! I was just talking to them. We would have recorded this an hour ago, but I had to talk to them first. Sorry.

Jay Currie: You have Justin out there with a hand drill, filming it for YouTube.

Peter Bell: He was doing it long before we came along and'll probably do it after we're gone, hopefully, with some massive success under our belt. We can dream! He's one of these young guys who's presented himself to the world on YouTube and said, "Hey, I like prospecting! I will teach myself prospecting and document as I do it." And you can look at the videos he shot four years ago. And then you can look at what he's doing now. Big progress! Partly, it's the ground. Partly, his skill set. But mainly, it's the thousands of hours of experience. These guys exist, and they haven't really been captured by the public markets because they are really interested in doing fieldwork, but most of the public companies aren't really geared for fieldwork, especially early-stage prospecting. They want to come in and get straight to drilling. And there's a lot more to be done before you just drill a few holes. I have found that we have a competitive edge with earlier-stage projects, like staking stuff and doing the first-pass work programs before we're into permitting drilling and doing drilling. There's a lot of room to advance projects quickly and cheaply at the earliest stages, and I'm not encountering a lot of competition there. When you look at some of these other areas, more advanced projects, there's a lot more competition from people with deeper pockets.

Jay Currie: Peter, we're going to do this podcast, and we're going to do it live from Duncan. Wandering around Mount Sicker, looking at pieces of rock with the 911 guys. And some of that rock has assayed for copper, hasn't it?

Peter Bell: Yes, we've had some impressive numbers. And remember that Mt Sicker had significant old mines, too.

Jay Currie: My sense is that you're on the other side of the mountain from where that mine was.

Peter Bell: Yes, that's the 911 SHOWING on the north side. Long story. It has been a mild winter so far, but now we are getting a bit of wind and even snow at higher elevations. I don't know if the snow will stick or not, but it sounds like there's some weather coming next week, so we may be doing more desktop computer work. That was one of the things I was talking to the guys about just this afternoon -- the conferences are coming with Cambridge House VRIC and AME BC Roundup in January. Whether or not we show up to those with any of our drill cores or slabs of specimen samples is a secondary concern to me -- my primary concern is what will be our public disclosure? Leading into those kinds of events, I would love to share a comprehensive review of what we've found and what we've learned from reading the history books about Sicker. What did those old timers miss, and what is now obvious to us?

Jay Currie: Peter, you might go so far, and I'm scared to say this, but you might do a corporate presentation.

Peter Bell: No, probably not. Not anytime soon. Not if I can avoid it. Then what? Zoom calls with investors? Are they really investors, though? This is no place for investors -- this is a place for speculators. We're a sub 1 million market cap public company. This is not a normal, safe investment. This is an ultra-high-risk speculation, and only people who have a clue of what we're talking about should even be thinking about looking into it because the odds are so far against us in so many ways.

Jay Currie: Just for completeness, if you had a company come to you and say, we would like to do a deal on Mount Sicker, then are you in a position where you can do that deal?

Peter Bell: Well, we don't have 100% of it yet. We ourselves have an option on it. Accelerating our option so that we can flip it to somebody else is a bit of a Herculean prospect in terms of share issuance. However, we can do creative things like get into joint ventures where somebody else is helping do some heavy lifting while this original option is still in force. Or it's possible to go back to the original agreement and say that somebody's coming in over-the-top, so let's tear up that original agreement and find something else that's win-win-win. The devil is in the details in terms of deal structure, what's legally possible, and what's possible with the Toronto Stock Exchange Venture. But the fundamental question that I can answer for you definitively now is that, yes, all of our projects are for sale all the time, one way or another.

*Woof!*

Jay Currie: I have to go let the dog out. Hang on. This is why doing a practice one of these is an excellent idea.

Peter Bell: It's all practice! And that's a big part of our business model -- multiple kicks at the can. A year ago, our priority exploration targets were clear. Now we look at those spots which aren't even in our top five. That's a very competitive attitude with very aggressive turnover that you don't usually see that action from exploration companies. Seems to me they often get a project that they like and spend 20 years advancing it.

Jay Currie: And you're perfectly happy to ditch a project if it's not doing what you want it to.

Peter Bell: Study my performance as a CEO for the last two and a half years to see the details. The one project the company had on the books when I got involved was abandoned within my first year as CEO. Since then, there has been a high turnover rate among deals that we consummate with an option agreement. We've been press-releasing all kinds of letters of intent to show the street the types of deals I'm looking at and the types of terms we're discussing. The kill rate on those deals at the letter of intent stage is enormous, too.

Jay Currie: One last question about KLM. What would your definition of a successful year in 2024 be?

Peter Bell: Looking back at 2023, I'd say that I'm grateful that we could run shares-for-services through the entire year. That was a significant accomplishment that I wanted to show we could explore work and corporate overhead using shares directly. We terminated stuff in Newfoundland, and we started this stuff in Nevada, which hasn't picked up much speed yet. We did deals with Milo in the Kootenays, and he did a summer season with less than $50,000 in prospecting work. Those experiences in 2023 gave me many data points that I have written up in our MD&A, management's discussion analysis, document that will come out as part of our audit and annual financial statements. I go into some details in calculating our corporate overhead spending and comparing that to our exploration spending because, before my involvement, the company didn't do a lot of exploration.

Peter Bell: One of the things that I care about is making sure that we know what business we're in and giving shareholders a chance to be part of a meaningful mining discovery. I take that thinking and transfer it forward to 2024. Rather than saying, "We're trying to swing for the fences and hit a home run to drill a porphyry discovery," that's not what we're going after. I want to be careful and avoid tremendous dilution to people who may not be true owners of the company but are renters or flippers of the shares. A whole bunch of stuff happens in the junior mining ecosystem that's not company-healthy.

Peter Bell: If we can avoid a lot of the worst of the worst and keep playing ball with the guys who are in it for the love of the game, then that's a start. If we can keep pursuing new property opportunities and building out the team, then those are the things I think of as success for the year.

Jay Currie: One of the things that is very strange about the junior space is that the accounting is not adapted to what is happening. For example, there is inherent value in sitting on Mount Sicker with some ridiculously high-grade copper showings. They have been found and staked, and you keep finding more. Now, what's that worth?

Peter Bell: Well, it's a negative. To my mind right now, it's a negative value because those mining exploration claims are more of a liability than an asset. You must pay cash instead of keeping the claims up, or you must do work! You have to pay to keep the asset in good standing. Otherwise, the government will take it right back from you. What kind of an asset is that? This is not a productive asset. Not yet, anyway. It has huge potential speculative value in terms of what could be hiding there and what someone else might pay to get their hands on it, but engineering a transaction that's accretive to shareholders based on that endowment is a complicated formula. The dark arts of junior mining stock promotion!

Jay Currie: Well, Peter, we should ring off at this point. We'll reconvene next week. I want to do this weekly—a couple of things for listeners. First, Peter will be a regular on the Talking Your Book Podcast. We won't always be talking about KLM. We'll be talking about other companies.

Peter Bell: There's a lot to talk about, Jay!

Yes, there is.

Jay Currie: And once we figure out the technical details, I suspect we will do some CEO interviews with CEOs of companies other than Kermode Resources. It will be fun because there are a lot of really interesting CEOs out there. I want to do something that is a little radical. I want to talk to people who are not CEOs who work for companies. I have a pal who's a rather serious GO and also a super good guy who I want to interview. I'd love to talk to Vanessa Pickering.

If you're out there, Vanessa. Hi, Vanessa!

Peter Bell: Orezone! Orezone! Orezone!

Jay Currie: Exactly. Til next time, Peter.

Peter Bell: Thanks, Jay!