Introduction

I touched on this topic a few weeks ago but wanted to circle back since the Federal budget has been released and some new information has come to light. In the newly released federal budget, the government announced its intentions to introduce a new 10% EV supply chain investment tax credit with the thought that it would attract new investments in the EV assembly, EV Battery Production and Cathode active material production in Canada. This marks the governments 6th major tax credit in the EV supply chain and one that compliments the 30% tax credit for Clean Technology Manufacturing announced in 2022. While these tax credits often feel like corporate welfare, they are designed to bring large corporations to Canada, create jobs and support Canada’s mineral resource sector. Clearly its working because several majors are bringing their operations to Ontario, but is it enough and is money being allocated accordingly? Since 2020 the Canadian Government has spent $46 billion investing in the ‘EV’ sector and that’s great, but It’s one thing to bring manufacturing of batteries to Canada, what about the raw materials needed to sustain it? By comparison, Canada has invested a little over 13 billion in mineral resource development under the same time frame. While at face value that sounds reasonable but in this article I’m going to show you why it’s not.

In a recent development, Honda and both the Ontario Provincial and Federal Governments made an announcement of their intentions to make Ontario home to 4 new EV focused facilities, joining Northvolt, Umicore, POSCO, Stellantis, BMW, LG Electronics and Ford to make Ontario a new battery manufacturing hub for the future. Honda’s intention to build in Ontario is part of their plan to achieve carbon neutrality and to be building 100% zero-emission EV’s in North America by 2040. Honda’s proposed EV supply chain will include a new CAM/pCAM processing facility through a joint venture partnership with Korean battery materials company POSCO Future M Co., Ltd. as well as a new separator facility through a joint venture partnership with Japanese chemical company Asahi Kasei Corporation. The Federal Governments commitment to the projects will be $2.5 billion which will be matched by the Provincial Government for a total investment of $5 billion dollars in subsidies.

Honda’s current operations include two automotive plants and one engine manufacturing facility. They have the capacity to produce more than 400,000 vehicles, 190,000 engines annually, employ over 4,200 people in Alliston and have a network of more than 280 dealerships across the country. This new investment will bring a substantial amount of jobs and production capability to Ontario, further bolstering Canada’s Automotive dominance. As it stands, Canada produces a car every 21 seconds, employs over 550,000 people in direct and indirect jobs, contributes around 18 billion dollars to Canada’s GDP and is one of Canada’s top exports at around 22%.

The Problem

With Electric Vehicle sales expected to triple by 2030, Canada is well positioned to be a major player in EV and Battery Production Sectors. Stats show that the EV supply chain will contribute up to $48 billion to Canada’s GDP on an annual basis and create more than 250,000 direct and indirect jobs. However, this will only be accomplished by also making significant investments in our mining and exploration sectors. Given that the global critical mineral supply is facing monumental challenges with war and supply line disruptions, It’s time to start bolstering the back end of the industry and invest the Canadian Mineral Resource Market.

For years Canada has propped up the oil and gas industry will billions of dollars of investments from both the provincial and federal governments. According to CAPP (Forecast Capital Investment for Canadian Oil and Gas) Canada invests around $40 billion dollars per year. Now, given that Oil and Gas accounts for 7.5% of Canada’s GDP and employs around 500, 000 people directly and indirectly across the country it, makes sense that there would be large investments, but I digress.

By comparison, the mining sector in Canada contributes $125 Billion or 5% of Canada’s GDP, accounts for 22% of Canada’s total domestic imports and employs 650,000 people directly and indirectly. Now don’t get me wrong, incentives exist but many of the efforts made on the federal level concentrate on mining support and training, environmental protection, reconciliation, and fostering partnerships. While these investments are important, they aren’t investments that are going to accelerate the critical mineral projects needed to meet the industrial demand. So to better understand my stance on funding let’s take a look at what is being allocated to the Mineral Exploration and Mining sectors in Canada.

Prior to Covid the Federal Government was contributing roughly $1.5 Billion dollars towards mineral exploration per year. However, in 2021, after massive trade disruptions due to the pandemic, that number rose to $3.8 Billion and in 2022 rose again to $4.1 Billion… And while these are drastic increases, the North American supply chain for critical minerals proved to be weak by comparison to our eastern counterparts, thus highlighting the need for these investments and were mostly reactionary measures. Sadly, the total dropped back to $3.7 billion in 2023, at a time when the mining sector could use a boost. So, does that allocation of funds sound right in relation to the GDP contributions towards the economy?

Now, it wouldn’t be a fair argument if I didn’t talk about other ways the Federal Government is incentivizing mineral exploration. One of the ways the Federal Government helps raise capital is through the “Mineral Exploration Tax Credit” (METC) by offering tax incentives to individual investors to finance early stage “grassroots” mineral exploration using flow-through shares. Additionally, there is a 30% “Critical Mineral Exploration Tax Credit” (CMETC) implemented in 2022 which directly supports Critical mineral projects. These two cannot be used in conjunction with one another but do add significant cost savings.

On a provincial level in Ontario, there is the Ontario Junior Exploration Program (OJEP) which offers grants to exploration Companies. Through the hard work of the current Minister of Mines, George Pirie, OJEP funding has been increased to $15 million. However, despite the increase, I would argue that the mining sector is equally important to the development of the battery sector and the level of funding should be comparable. In saying that, there are various other grants, funding options, green tech incentives and ESG programs available but most aren’t focused on mining and more targeted towards the supporting infrastructure and green technology that indirectly supports mining. While this does benefit the mining industry, it doesn’t do much for the exploration companies who find the mineral resources and develop them to construction ready status.

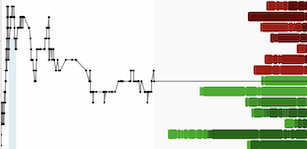

The Breakdown

Oil and Gas

- Direct and Indirect Jobs – 500,000

- Annual GDP Contributions – 7.5% or $157 Billion

- Government Funding Since 2020 – $160 Billion (approximately)

EV/Automotive Manufacturing

- Direct and Indirect Jobs – 500,000 + up to 250,000 through the EV Supply chain by 2030

- Annual GDP Contributions – $18 Billion + up to 48 Billion through EV supply chain by 2030

- Government Funding Since 2020 – $46 Billion (approximately)

Mining & Exploration

- Direct and Indirect Jobs – 650,000

- Annual GDP Contribution – 5% or $125 Billion

- Government Funding Since 2020 – $13.1 Billion (approximately)

By the numbers, the mineral exploration and mining sectors are vastly underfunded when comparing to relatable industries with similar GDP contributions. In fairness, Oil and Gas subsidies are due to come down as recent regulations have been tabled to limit government support, so maybe a change is coming, but let’s be honest, this should have happened years ago. Canada’s Mining industry is a global powerhouse and Canada can’t afford to sit on the sidelines when EV demand is soaring. If the current governments goal is to combat climate change as they claim, then they need to invest in the mining sector and give the EV Industry a backbone. I’d like to think their is no corporate influence playing a role here, but when you start looking at the numbers the disparity stands out like a sore thumb weighing heavily in favour of oil and gas.

Conclusion

In conclusion, at a time when we have such global instability, supply chain disruptions, wars and manipulation happening in the markets, now would be a great time to step up and support the very industry that built this country in a meaningful way with direct investments and policy changes that accelerate projects to meet the growing demand for critical minerals. You can’t build a battery without resources and with a bit of help, Canada can unlock a vast wealth of value that will not only drive the economy but provide the materials needed to support the developing battery industry.

Authored by: Mike Coyle

To view the original article please visit Insidexploration.com or follow the link below

References

https://electricautonomy.ca/news/2022-09-14/report-ev-economy-clean-energy-canada/

https://www.capp.ca/en/our-priorities/energy-and-the-canadian-economy/