by James Kwantes

Published first at Patreon

Companies that own a less-than-100% stake get a bad rap among junior mining investors. Who wants only 20 or 30% of a world-class discovery?

It's a misleading question. Juniors can preserve their share structure & treasury with that type of deal -- and piggyback on exploration funded by a deeper-pocketed partner. The discoveries, if they occur, happen much later. And the minority stakes can become valuable.

I've written about how Kenorland Minerals (KLD-V) CEO Zach Flood converted a 20% JV stake in the Frotet project into a 4% NSR that is likely worth more than KLD's current market cap.

One of my favourite minority stake exit stories is Aber Resources' sale of their 32.2% stake in the Snap Lake diamond project to De Beers back in late 2000. The Aber-Winspear Diamonds JV was formed in the wake of the great Canadian diamond staking rush that followed Dia Met's 1991 discovery of what became the Ekati diamond mine.

De Beers had earlier paid $305 million for Winspear Diamonds, a sweetened amount secured by Winspear CEO Randy Turner after an initial $260M offer. But Winspear owned just 68% of Snap Lake. Read more here.

The other 32% stake was owned by Gren Thomas's Aber Resources, no stranger to diamond discoveries. At the time, Aber had 40% of Diavik, which was being developed by 60% owner Rio Tinto.

The $305M deal for Winspear implied a $145-million valuation for Aber's 32% stake in Snap Lake. But De Beers paid Aber $173 million for the minority stake -- an almost-20% premium.

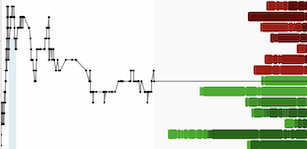

There's a similar scenario playing out right now in Finland's Central Lapland Greenstone Belt (CLGB), an emerging gold district. The main players are Rupert Resources (RUP-T), B2Gold (BTO-T) and Aurion Resources (AU-V). The Crown jewel is Rupert's high-grade and wholly owned Ikkari project, one of the best gold discoveries globally in recent years.

Rupert reported an initial maiden resource estimate of 3.95 million oz based on just 36,000 metres of drilling. There's a big wrinkle, however. Rupert's proposed open pit at Ikkari is constrained by a property boundary on the south.

To the south is B2Gold-Aurion's (70%-30%) joint venture ground, which hosts both high-grade and lower-grade-but-economic gold discoveries. One of those discoveries, Helmi, hosts mineralization along about 2 km of strike on trend with Ikkari, starting roughly 1.5 km away.

It's not just the boundary that is problematic. Rupert's own deck suggests the high-grade Ikkari gold extends into the JV property.

Rupert recently made a move, offering B2Gold the equivalent of $102.8 million in Rupert shares for their 70% JV stake. In addition to the other 30%, Aurion has a 60-day right of first refusal (starting March 11) on B2Gold's 70% and can match Rupert's offer.

Rupert's offer implies a $44-million valuation for Aurion's 30% stake. As we saw in the case of Aber and De Beers, however, the math is not always straightforward.

There are other major players here. $43-billion market cap Agnico Eagle (AEM-T) operates the nearby Kittila gold mine, Europe's largest, and owns 14.1% of Rupert shares. Kinross Gold (K-T), market cap $11B, owns 10% of AU shares, is earning in to 70% of another Aurion property (Launi East) and has wholly owned ground in the neighbourhood.

Aurion, market cap $94M, stands to benefit however this plays out. Aurion's chairman, Dave Lotan, owns 10% of AU shares and is a veteran, well-connected operator in the space.

Purchase some popcorn. Stay tuned.

Disclosure: I own Aurion shares and have worked with the company previously. No business relationship with any company mentioned. This is not investment advice.