The Weekly Dig - February 24, 2017

Mick Carew, PhD, mcarew@haywood.com

and The Haywood Mining Team

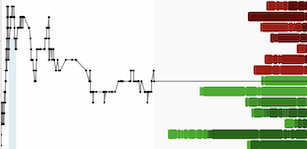

Gold Mining Equities Slide despite Gold Surging Above $1,250

Highlights:

· It was an unusual week for gold mining equities. While the price of gold surged amid weakness in the U.S. dollar, gold mining equities followed a downward trend, with the S&P/TSX Gold Mining Index falling 1.5% this week to finish at 216. The gold price surged past the $1,250 level, briefly touching $1,260 per ounce before settling at $1,256 per ounce on Friday. Global markets in general were mixed; the S&P/TSX Composite Index fell almost 350 point to close at 15533, while the Dow Jones Industrial Average closed higher for the week, up 50 points to 20821. The mixed performance in global markets followed a number of comments made by President Trump, which included his willingness to increase his Country’s nuclear arsenal. Furthermore, some commentators have alluded to the end of the “Trump Bubble”, a term used to link the recent surge in equity markets since the election to the promise of greater infrastructure spend in the U.S. Meanwhile, comments by the Federal Reserve stating “uncertainty regarding the impact of possible tax cuts and other White House economic policies" also weighed on global markets. Silver (up 1.90%), platinum (up 2.2%) and palladium (up 0.80%) finished the week higher at $18.35, $1026 and $771 per ounce respectively. After last week’s commentary in the Weekly Dig, the daily Broker Average Price (BAP) of uranium fell further this week; down 9.8% since last Friday. Base metals were varied with copper down 0.51% and nickel down 1.71%, finished at $2.68, and $4.90 per pound respectively. Lead was up 0.59% and zinc was up 0.77% finishing at $1.02 and $1.28 per pound respectively. Rounding the week off was WTI crude, which was unchanged this week at $54 per barrel.