September 29, 2017 (in Hong Kong)

By: Gianni Kovacevic

This past week I was in Singapore to participate in the Financial Times Asia Commodity Summit. One of the key themes discussed throughout the day, was the future of oil demand. My session, moderated by Henry Sanderson, was titled, "Electric Dreams: The Battery Revolution and Commodity Markets."

The input I aimed to provide, was for participants to consider some alternative views, especially in areas of their non-expertise that will impact the future of energy.

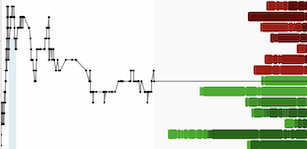

A recent article on Bloomberg showcased a few scenarios for investors to consider. The graph below depicts an incumbent view of future oil demand.

That, of course, is the old orthodoxy (Ed note. Michael Liebreich, BNEF's founder, used that term quite extensively in his "State of the Industry" Keynote at the recent BNEF Summit - a must view if you follow energy. View here.) So what could Big Oil and the likes of the International Energy Agency be missing?

The Consumer!

The amplified relevance of the consumer cannot be underlined enough when discussing the future of energy, and oil demand specifically. When I asked the audience at the Asia Commodity Summit - mostly traders and senior analysts in commodities - who had actually driven an electric vehicle a distance of 600km or 700km between two cities over the course of a day - not one person had done so.

How then, could one really appreciate the gravity in the revolution currently taking place in global transportation? The quote from Don Coxe on the top of this e-mail, speaks volumes to this.

What about:

- Uber or Lyft - the shift to transportation access, not ownership?

- Car sharing like Car2Go or BMW's Now?

- The existential threat that Big Auto has from Big Tech encroaching on their territory?

- The impact of on-line shopping?

- The countless millions of millennials who will never obtain drivers licences?

- The fuel efficiency increases mandated on passenger vehicles, road freight, aviation etc?

- New regulatory (ambition?) (abuse?) that cities and countries the world over are imposing on society and industry?

- When consumers adopt superior forms of transportation based on cost, not price?

If a 2 million barrel per day supply glut was able to collapse the oil price by 70 percent, then shouldn't investors and energy trade participants care about the delicate balance of supply and demand in the future? Obviously, yes.

Here is another graphic to consider when layering in some efficiency, innovation and adoption.

Happy investing,

Gianni Kovacevic | Executive Chairman, CopperBank