Introduction

I read this a few months back but have only just got around to finalising my notes. An interesting book from an interesting guy. I have read all the books he has produced and this is one of the better ones as it’s in-line with my favourite topic…managing money. Because of his success, he has been able to talk to some of the worlds astute investors and glean their strategies and put them across is simple, easy to understand ways. Tony not only gives financial advice, but I think the advice he offers for living a good life is also important. Enjoy!

Waste no more time arguing about what a good man should be. Be one. - Marcus Aurelius

Money is only a tool. It will take you wherever you wish, but it will not replace you as the driver. – Ayn Rand

Keep expenses low and remember compounding.

The purpose of business is to produce happiness, not pile up money.

Provide a product or service people want – meet the needs and wants of others.

Keep your costs low but quality high.

We live in an uncertain world, and face not only the risks of the known unknowns but also the unknown unknowns: the ones that “we don’t know we don’t know”.

Focus on what you can control, not on what you can’t.

Control what you can control.

Any decision made in a state of fear is likely to be wrong.

Decisions equal destiny.

Knowledge is only potential power. Execution trumps knowledge.

We can know that something will happen but not when or its severity.

Figure out who you can and cannot trust.

We learned to recognise and utilise patterns.

We are not rewarded when we do the right thing at the wrong time.

Corrections occur on average every year.

Less than 20% of all corrections turn into a bear market.

Nobody can predict consistently whether the market will rise or fall.

The best opportunities come in times of maximum pessimism.

Bear markets become bull markets, and pessimism becomes optimism.

The stock market is a device for transferring money from the impatient to the patient. – Warren Buffett

You miss the shots you don’t take.

Hell is truth seen too late. – Thomas Hobbes

People want freedom. Freedom to do more of what you want, whenever you want, with whomever you want.

We are lousy at making predictions.

You get what you pay for – except when you don’t.

Be aware of what things should cost versus what they actually cost.

You must keep your costs low.

It is difficult to get a man to understand something when his salary depends on his not understanding it. - Upton Sinclair

Figure out people’s incentives.

Check out the credentials. Track record.

Make sure you are aligned philosophically and relate on a personal level.

It’s not enough to know a principle. You have to practice it.

Execution is everything.

Don’t lose. How can you avoid losing money?

The more money you lose, the harder it is to get back to where you started.

Focus on the downside. Guard yourself against the risk of unexpected events.

Design your asset allocation that ensures that if you’re wrong, you will still be ok.

Always expect the unexpected.

The rewards should vastly outweigh the risks. Risk as little as possible to make as much as possible.

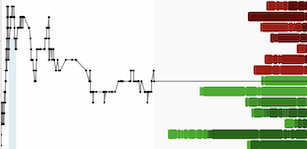

1) Diversify across different asset classes

2) Diversify within asset classes

3) Diversify across markets, countries, and currencies around the world

4) Diversify across time

Everything is cyclical.

Own uncorrelated investments that don’t move in tandem.

Don’t be a coward. Take smart risks. Uncertainty isn’t an excuse for inaction.

You can’t give another person control over your destiny.

Risk comes from not knowing what you’re doing.

Sales, problems, fear, negativity are your opportunity.

Bear markets will accelerate your financial freedom.

Find internal certainty and you will be excited when the market crashes.

Be fearful when others are greedy, and be greedy when others are fearful. – Warren Buffett

Bear markets are either the best of times or the worst of times, depending on your decisions.

Surviving a bear market comes down to preparation.

The ideal portfolio is to balance the return you need to achieve with the risk you are comfortable taking.

When you buy a stock you become a part owner of an operating business.

By investing in a stock you become an owner, not a consumer.

Bad news is an investors best friend.

When you buy a bond, you are making a loan.

The type of assets you own should be matched to what you personally need to accomplish.

What asset classes will give you the highest probability of getting from where you are today to where you need to be.

Your needs determine your asset allocation.

Asset allocation drives returns.

Never bet your future on one country or one asset class.

Always have a financial cushion.

Have, ideally about seven years of income set aside.

You are your worst enemy. You are your biggest threat to your financial well-being.

Our brains are wired to avoid pain and seek pleasure.

We seek immediate reward.

What counts is not reality, but rather our beliefs about it.

Beliefs are nothing but feelings of absolute certainty governing our behaviour.

We need simple systems, rules, and procedures to protect us from ourselves.

Know what to do, do what you know.

Make sure that it’s a ‘hard trade’ – meaning it wasn’t a trade that everyone would make.

Have a simple set of questions to examine your beliefs and look at the situation more objectively.

80% of success is psychology and 20% is mechanics.

Know your limitations to adapt and succeed.

Welcome opinions that contradict your own. Don’t seek confirmation of your beliefs.

We place greater value on something we already own, regardless of objective value.

Never fall in love with an investment.

Ask better questions and find qualified people who disagree with you

Buy wonderful businesses at fair prices.

Ask, what don’t I know? What’s the downside?

Don’t mistake recent events for ongoing trends.

We project out into the future what we have most recently been seeing.

Recent experiences carry more weight in our minds when we’re evaluating the odds of something happening in the future.

Great things are not accomplished by those who yield to trends and fads and popular opinion. – Jack Kerouac

Today’s winners tend to be tomorrow’s losers.

We are overconfident and overestimate our abilities and our knowledge.

We have a perilous tendency to believe we are better (or smarter) than we really are. We consistently overestimate our abilities, our knowledge, and our future prospects.

The stock market is a device for transferring money from the impatient to the patient.

Buy when people are suicidal.

By failing to prepare, you are preparing to fail. – Ben Franklin

It’s the feeling we’re after. Not money itself. The sense of freedom, security, comfort , joy is what you’re after.

Real wealth is emotional, psychological, and spiritual.

Live a magnificent life on your own terms.

The first step to achieving anything you want is focus. Wherever your focus goes, energy flows. Second step is to go beyond hunger, drive and desire and consistently take massive action. Third is luck.

Our needs and desires are different for everyone.

You must keep growing. Everything in life either grows or dies.

You have to give. You make a living by what you get. You make a life by what you give. – Winston Churchill

We’re driven by our desire to contribute. If we stop feeling that deep sense of contribution, we can never feel truly fulfilled.

Money doesn’t change people. It just magnifies who they already are.

Success without fulfilment is the ultimate failure.

If you’re not fulfilled, you have nothing.

Help yourself first, then others

You are the product of your thoughts. What you think, you become.

We can’t control all the events in our lives, but we can control what those events mean to us.

The human brain isn’t designed to make us happy and fulfilled. It’s designed to make us survive.

The brain looks for what’s wrong, for whatever can hurt us, so that we can either fight it or take flight from it.

An undirected mind operates naturally in survival mode, constantly identifying and magnifying those potential threats to our well-being. This equals a life filled with stress and anxiety.

We make unconscious decisions based on habit and conditioning.

The mental and emotional state in which you live is ultimately the result of where you choose to focus your thoughts.

When you focus on loss, you become convinced that a particular problem has caused or will cause you to lose something you value. This sense of loss can also be triggered by something you did or failed to do.

When you focus on the idea that you have less or will have less, you will suffer. Less can be triggered by what you, or others, do or fail to do.

When you focus on the idea or become consumed by a belief that you’ll never have something you value, you’re doomed to suffer, you’ll never be happy, you’ll never become the person you want to be.

The mind is always trying to trick us into a survival mindset.

Whatever we focus on, we feel-regardless of what actually happened.

Your focus creates your feelings, and your feelings create your experience.

Most, if not all, or our suffering is caused by focusing or obsessing about ourselves and what we might lose, have less of, or never have.

Either you master your mind or it masters you.

Our lives are shaped not by our conditions, but by our decisions.

Commit to being happy, no matter what happens to you.

Life is just too short to suffer.

Find something to appreciate in every moment.

You don’t have to believe your thoughts or identify with them.

What’s wrong is always available….but so is what’s right.

It doesn’t matter what you appreciate. What matters is that by shifting your focus to appreciation, you slow down your survival mechanism. Find the good in every situation.

The more you use it, the better you get.

To overcome fear, the best thing is to be is to be overwhelmingly grateful. – John Templeton

Take all your negative thoughts and all of your negative emotions, trade them for appreciation.

Find something to serve, a cause you can be passionate about that’s greater than yourself. Nothing enriches us as much as helping others.

Time and health are two precious assets we don’t recognise and appreciate until they have been depleted. – Denis Waitley

With all insurance, your first step is to determine exactly how much coverage you need.

Conclusion

Definitively one of his better books. Tony is very good at breaking down ideas into an easy to understand form. He has interviewed some of the most successful investors in the world, something many of us will never get the chance to do, and he has clearly defined many of the principles that these successes have used. Use them too if you feel they offer you value.

Many of the ideas are probably well understood by most of you reading this, but it helps to repeat them continually so they are understood. Remember, what is easily understood can be difficult to implement. We have many barriers to face and most of them are psychological barriers like your own emotions.

Try not to worry about what you cannot control, as you can’t do anything about it anyway. Your efforts should be purely focussed on what you can control. Remember, the goal is not money, it is freedom. And you must buy your freedom. That’s just the way it works. Nothing is free in this life and everything you do, or do not do, has consequences – both good and bad.

Not losing money should be your focus. If you lose money it loses the compounding effect, which ultimately is what will help you get your financial freedom. Remember to spread some risk about so if one blows up, you will still be OK.

Alan