The surest way to build wealth is to spend less than you make and put the balance to work in stocks.

Insurance stocks were how Davis made his wealth.

There is no guarantee that a fast-growing industry with great future promise will reward its financial backers along the way.

People who look for a payoff at minimal risk were investing. People who paid silly prices for the unrealised potential of celebrated upstarts in promising but unproven endeavours were speculating.

“If you had one silver bullet to shoot a competitor, which competitor would you shoot?”

Don’t be a bondholder. Bondholders are lenders. Be a shareholder. Shareholders are owners.

The greater the return, the faster the compounding.

Out of crisis comes opportunity.

A down market lets you buy more shares in great companies at favourable prices.

A dollar spent was a dollar wasted; a dollar unspent could be sent off to compound.

Waste not, want not.

Big money was often made in sluggish industries. Smart, aggressive, resourceful companies distinguish themselves in sluggish industries. They can run mediocre competitors out of business or buy them out. In trendy industries (computers, biotech), everybody’s smart, aggressive, and resourceful, these qualities can threaten an investment.

Use it up, wear it out, make do, or do without.

Putting ideas on paper forces you to think things through.

Acquire, grow, and cut costs.

Can you double what you earn in 5 years?

Investing is trying to realise value.

It’s unrealistic to expect companies to grow at 15% for extended periods.

Your best bear protection is buying companies with strong balance sheets, low debt, real earnings, and powerful franchises. These companies can survive bad times and eventually become more dominant as weaker companies are forced to cut back or shut down.

Try not to be too positive about short-term successes, or too negative about short-term setbacks.

Every trendy industry in one decade has a habit of destroying its backers in the next.

A perfect value play occurs when a company’s tangible assets (cash in the bank, buildings, machines, and so on) will fetch more in a going-out-of-business sale than can be realised in the current market.

Value companies tend to have problems, and a stock that looks cheap today continues to get cheaper.

The ability to see the next New New Thing and the courage to take a chance on it, plus the scepticism and the flexibility needed to abandon the New New thing before it succumbs to the New New New thing.

Every trendy industry in one decade has a habit of destroying its backers in the next.

Value investors ignore the wanna-bes and concentrate on the has-beens.

Look for steady profit. Insurance and finance.

Investing is deploying cash today, hoping to get more cash back in the future.

What kind of business to buy? How much should you pay?

A company worth buying makes more money than it spends. The profit is recycled for maximum shareholder benefit.

Look at owner earnings. Look at how much debt. Basically, net worth and earnings.

Compare expected future payoff from holding a stock to the payoff from holding a government bond. Bondholders receive predictable payments; a stock’s benefits are potentially superior but often less reliable.

1. Avoid cheap stocks. Most cheap stocks deserve to be cheap because they are attached to poor companies.

2. Avoid expensive stocks. No business is attractive at any price. Don’t overpay for earnings.

A stock down 50% must rise 100% to break-even point.

3. Buy moderately priced stocks in companies that grow moderately fast.

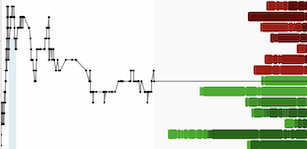

4. Wait until the price is right. Bear markets make people a lot of money, they just don’t know it at the time.

5. Don’t fight progress. Find companies at value prices with real earnings and established franchises.

6. Invest in a theme.

7. Let your winners ride. Buy at a bargain price you can live with for a long time. Once it reaches fair value, keep it so long as its earnings are rising. Be comfortable owning stock in recessions. You will learn how the company handles bad times as well as good.

8. Bet on superior management. Follow the talent. Assess the leadership.

9. Ignore the rear-view mirror. History doesn’t exactly repeat itself.

10. Stay the course.

Every company should have:

• First-class management with proven record of keeping its word.

• Does innovative research and uses technology to maximum advantage.

• Operates abroad as well as home.

• Sells products or services that don’t become obsolete.

• Insiders own a large chunk of shares and have a personal stake in the company’s success.

• Delivers strong returns on investors’ capital, and managers are committed to rewarding shareholders.

• Expenses are kept to a minimum, which makes the company a low- cost producer.

• Enjoys a dominant or a growing share in a growing market.

• Adept at acquiring competitors and making them more profitable.

• Strong balance sheet.

Conclusion

I took me a while to get through the book, even though it’s only 154 pages long! I’ve had lots of commitments and generally been spending longer contemplating the ideas in, what I think are, great books.

This book tells you how Davis made lots of money. It really shows you how to pick investments. When I say investments, I mean quality capital-efficient businesses that produce earnings and rewards shareholders.

I’ve thought a lot about both investing and speculating and their differences, and I’ve become more interested in the former over time. I was far too exposed to speculative securities than I should have been and I’m still reducing my speculative positions to bring the percentage more in-line with my own ‘tolerance level’. What I mean to say is that I’m learning more about myself. By acquiring more knowledge and experiences, you learn more about yourself. How patient you are, how much risk tolerance you have, dealing with boredom, capital allocation decisions, handling loss, and a myriad of other things. But as you acquire more capital, knowledge, and experience, make mistakes and learn from them, you become better at what you do. You will identify more opportunities and understand your own unique ‘investor profile’ better than anyone else. It’s understanding your own psychology. That’s what I’ve been trying to figure out recently.

This book taught me that you don’t have to take insane risks and deal with epic volatility to do very, very well. You can also make a fortune later in life. I say just start from where you are right now and move forward at a comfortable, intelligent and smart pace. Test yourself from time to time. A bit of pressure and feeling uncomfortable are good for you. Everything in moderation. It helps teach you more about how you react in difficult, stressful and emotional situations.

Another thing I’ve been thinking about is taking your initial invested or speculative capital back and having ‘free shares’ to keep for the long term. Reinvest the dividends and let them compound. You could end up with a portfolio full of cash and frees shares working for you. Once bargains come about with the best people, align yourself with them and at terms that are better than they got if possible.

As I’ve been reducing my speculations I’ve kept a few free shares in some stocks. I sold out my initial investment and kept the profitable portion of the remaining shares to just run for a while. I’ll reassess when things look ridiculously expensive or something changes that I require additional capital for some other more profitable opportunity turns up.

But what it all comes down to in the end is the act of saving money and putting that money to work in the best way possible to generate the returns you would desire at a level of risk that you can tolerate and understand.

Alan