DISCLAIMER: None of this content constitutes financial advice. This newsletter is strictly educational and does not offer investment advice or solicitations to buy or sell any assets or make financial decisions. Please exercise caution and conduct your own research. Management has not reviewed or confirmed the accuracy of the information provided here. I was not compensated by management for this work, and while I have strived for accuracy, there may be inaccuracies.

If I am ever compensated for an article, it will be disclosed here.

Hello!

Since the daily market updates were becoming a grind, I wondered, “What is another way to add value?”

You may have received my last email where I mentioned spending quite a bit of time in Google Sheets creating the ‘Wingman’s Checklist’ and the ‘Resource Calculator.’

Well, I decided to put them to good use and created a method to review companies using the criteria from the checklist.

Not all the information depicted in these graphics is from the checklist; instead, I crafted my own ‘deck’ for reviewing companies, emphasizing factors that I consider important. The checklist serves as a tool for due diligence, but ultimately, the findings are up to you!

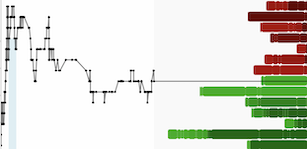

Here is my best effort at displaying those findings in an easy-to-understand manner, focusing on the 9C’s that comprise Wingman’s Checklist.

The first company I want to discuss is one that I am personally invested in, First Phosphate.

Any feedback on this review is welcome!

They are currently undergoing a 25,000 metre drill program. At a cost of $200 per metre, we can assume $5,000,000 of that working capital is spoken for. After this drill program they will be moving forward with a Preliminary Economic Assessment.

The phosphate industry lacks coverage compared to some other commodities, making it less transparent. While Argus provides commentary on the market, someone also recommended keeping an eye on the wheat market, given phosphate's significant use in agriculture.

However, First Phosphate focuses on battery-grade phosphoric acid. It's an intriguing commodity, and I personally find it challenging to assess the supply/demand dynamics.

Now that I'm invested in First Phosphate, you might find the ranking of 5.50 out of 10 to be rather harsh. Well, the Wingman’s Assessment Value (WAM) can indeed be stringent for early-stage companies. The stage of development plays a significant role; the less developed the company, the more challenging it is to achieve a higher score!

Considering a junior exploration company with over C$5 million in cash is respectable, particularly given their substantial land package containing rare, high-purity phosphate deposits in Quebec, Canada.

To see how other companies compare, you'll need to subscribe. Over time, I expect to build a comprehensive archive of reviews for various companies. Even so, this is just a snapshot in time. But it is still a good exercise to do and helps you better understand your investments!